Cryptonetworks as Sovereign Digital Economies

How should you think about "layer-1" cryptocurrencies like Ethereum, Solana, etc. (i.e. those supporting applications to be built on top of them)? Industry vets have variously claimed that they're nation states or city states. Indeed, in this fascinating Bankless episode, the two hosts discuss the analogies in great detail with the co-founder of Cosmos. They conclude that while the Ethereum vision is for a unified “benevolent empire”, the Cosmos vision is to have fully sovereign zones that can communicate. Regardless of whatever analogy ends up being most prescient, I believe one thing to be unambiguous: these are sovereign digital economies. This post will make the case for this categorization and delve into its implications if it does come to fruition in full.

At the most fundamental level, what is the purpose of government? Stripping out the services like public education or healthcare that doesn't necessarily need to provide but does so anyway, the ultimate purpose is to support a free market economy. What does this mean? It means providing security and diminishing the role of interpersonal trust in economic transactions so that in a nation with 300M perfect strangers each person can transact with one another in a disinterested way – i.e. without having to know them personally, their family or how to track them down in person in the case something goes wrong.

What are the most important prerequisites for this to happen? Paradoxically, freedom necessitates a baseline level of control and enforced order. Otherwise, a collection of 300M people with no leader, no structure, and no rules would promptly devolve into pure chaos & anarchy; indeed, history has taught us over and over again that such an amorphous society leads to authoritarian regimes filling the void because they offer the appealing value proposition of bringing an extreme degree of order, structure and leadership to a group experiencing an equally extreme depravity of all three. Note that such scenarios hold up to Newton's third law: For every action, there is an equal and opposite reaction. Thus we have the odd reality that absolute freedom leads to absolute control. Hence, a government seeking to support a free market economy must provide the following baseline level of control and order:

- Property rights: recording and tracking who owns what scarce resource

- Legal enforcement of property rights (as well as inter-personal dispute resolution): having a court system that fairly determines who owns what resource in the case of a disagreement

- Safety from international and domestic threats: my property rights don't mean anything if tomorrow my neighbor kills me / an angry mob burns down my house or if the U.S. is wiped out by a nuke / an international invasion –> thus the U.S. spends ~4% of its GDP on the military (protection from international threats) & police (protection from your neighbors & mobs)

In other words, at the most fundamental level, the government secures property rights. Note that it works in other ways to further diminish the role of trust and reduce the friction of transacting with strangers. For instance, public investors can be quite confident that any SEC-registered company isn't an outright scam without having to visit the headquarters themselves and dig through thousands of pages of documents. Lowering investors' friction costs makes it far cheaper for American companies to raise money from perfect strangers to invest in their business and ultimately to provide goods & services to perfect strangers.

How does the government pay for providing these services for the economy? Well, it takes a slice of the economic production that it helps facilitate. It has three options to do so: explicit taxation, implicit taxation via inflation, or taxation of future earners via debt financing. While these options have vastly different economic implications depending on their implementation, they all take a slice off of economic production and redistribute it towards the government's desired ends. Thus, they're directly proportional to the size of the GDP supported by that gov –> so, bigger economy = more gov revenue to provide more security. This leads to a flywheel effect: the country with the most secure property rights and lowest friction to conducting business attracts the most amount of talented entrepreneurs… who create the best businesses… that make the best products at the cheapest price… which improve the standard of living of the nation's citizens… which makes those citizens wealthier and attracts more citizens from elsewhere… which raises the nation's aggregate wealth… which raises the amount of money that the gov can tax… which allows it to provide better security and services… and arooound we go. And, noticeably, anyone who wants to participate in the economy must buy and hold US dollars, because if you want to make a transaction within the US economy or otherwise buy American goods or services or buy foreign assets denominated in USD (like oil) or buy shares of US-based companies or other financial assets, you must first buy the USDs themselves. This, combined with the IRS' threat of jail time for those who don't feel like paying their taxes, ensures that these floppy pieces of paper without any intrinsic value always have value.

Smart contract platforms are sovereign digital economies.

They secure digital property rights for a digital economy built on top of it. Fungible tokens, NFTs, tokenized data, etc. are all ways of expressing control over the ownership of and/or access to a verifiably scarce digital resource. Just like national governments, these sovereign digital economies must secure these digital property rights for them to have any value. Whereas national governments use the rule of law, the court system, the police, the military, social norms, and economic incentives to do so, smart contract platforms like Ethereum use mathematics, cryptography, programmable code, and economic incentives to achieve the same goal. And, just like national governments, smart contract platforms pay for this security by taking a slice of their economy's GDP. The difference is that their main mechanisms of taxation are inflation and a per-transaction tax rate (like a sales tax that's levied at every transaction as opposed to an income tax that's collected at the end of the year). A key novelty of the digital economy is that its very own citizens provide the economic security: the new token issuance goes directly into the pockets of those who protect the network by staking their holdings. The economic security they provide is equal to the total amount they stake.

So, just like physical nation states or any other entity, digital economies' long-term survival will be determined by the following equation:

Profit = revenue - expenses

= slice of the pie - security expenses

= size of the pie * percentage taken - token issuance

= transaction fees ($) - token issuance ($)

As indicated by the third line, the larger the GDP the smart contract platform supports, the more revenue it can collect to pay for more security. And, because these digital economies are only as valuable as they are secure, we once again have a flywheel effect – which is eerily similar to that of the physical nation state: the digital economy with the most secure property rights and lowest friction to conducting business attracts the most talented developers… who create the best projects… that make the best products at the cheapest prices… which improve the standard of living of the digital economies' citizens… which makes those citizens wealthier and attracts more citizens from elsewhere… which raises the nation's aggregate wealth… which raises the amount of money that the platform can tax… which allows it to provide better security and services… and arooound we go. And, once again, anyone who wants to participate in this digital economy must transact in and hold its native token, thus bestowing that token the status of defacto reserve currency and the all-coveted monetary premium that comes with that status.

The most crucial difference between physical nation states and their digital analogues is that the latter is permissionless. That means anyone can participate however they so desire. It means their citizens don't need to wait years for their citizenship applications to be approved or have anchor babies to expedite the process, don't need to ask banks' permission to have access to basic financial services, can maintain complete control and custody of their digital assets if they desire, can hold passports to as many competing digital economies as they desire while keeping their physical one, and cannot be arbitrarily de-platformed or censored. In other words, built into these digital economies' very codebase are the following rights, among others: freedom of speech, security against unreasonable searches and seizures, and impartial juries (i.e. smart contracts). Because every participant has these rights in addition to the ability to express their voice with their governance vote, their wallet, and their feet (by switching to another platform at the click of a button), these digital economies cannot compete with other digital nation states nor with physical ones in a coercive manner. They have no IRS or police force to go after you. Without a monopoly over force or violence, these platforms can only attract participants by providing significantly more value to its citizens than other platforms on offer. History has taught us that individuals, communities, companies and countries that must compete on a free market based solely on their competence and the quality of their output tend to be ruthlessly efficient and effective.

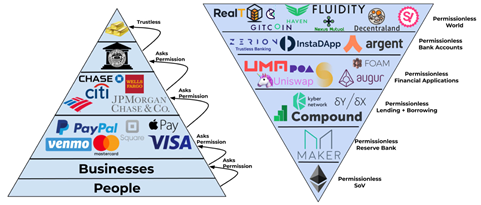

All of this has two major implications, neither of which can be emphasized enough. First, these economies' permissionless nature flips the model on its head, as seen by the diagram below. Every layer is permissionless and decentralized. This makes these digital economies truly global: anyone in the world with an internet connection can instantly gain access without needing to ask permission.

Second, I feel the need to reiterate what I said previously: these digital economies will be competing for economic participants and resources directly with physical nation states. Now, this doesn't pose a threat to governments' line of business as long as these networks sit on top of the physical nation states. More specifically, as long as the money flowing around these networks eventually gets settled in USD, then all is well. Think of the internet as it historically has been. The internet can be thought of as a massive digital economy. However, because all transactions are by nature denominated in USD, it is not a sovereign digital economy. It's merely a digital extension of the traditional economy. Everything done over the internet, everyone relying on the internet for their work, and everyone building applications for the internet conduct every transaction in USD without even thinking about it.

On the other hand, an economy built on top of, say Ethereum, would by nature settle every transaction in ETH. Everything done on Ethereum, everyone relying on Ethereum for their work, and everyone building applications for Ethereum would conduct every transaction in ETH. Again, this does not pose a problem if those people then convert their ETH back into USDs and go about their day. In that case, the US government still has complete control over its finances.

If, however, the economy built on Ethereum continues to grow exponentially for long enough that it eventually supports truly meaningful economic activity, then people may not convert their ETH right back into USD since they'll be using it again tomorrow. With enough momentum and legitimacy, the population may even begin to store large portions of its wealth in ETH. That is when things get dicey.

When the Ethereum network is no longer merely a digital extension of the traditional economy like the internet has always been – i.e. when people think twice about whether they want to transact in and store their wealth in ETH or USD, then Ethereum would switch from being a network sitting on top of the US government to one sitting alongside it, whose money competes directly with the USD. This would threaten the government's single most sacred artifact: the ability to print debt & money indefinitely.

The US government's control over its own currency combined with the fact that all of its debt is issued in that currency means that it can never run out of money. Whereas households and businesses can see their income streams dry up, literally run out of money and be forced to file Chapter 11, the US government can never be forced into insolvency. No matter how much its debt outruns its revenues, it can always create more money ex-nihilo and instruct the Fed to monetize its debt.

The only constraints that government's with debt issued in their own currency face are social & psychological in nature: the willingness of individuals to transact in and store their wealth in the currency. That in turn depends on a) people's expectations for the currency's purchasing power in the future and b) access to attractive alternatives. The former is rooted in the past but influenced by the trends shaping the future. The main way people understand a currency's stability today and project its stability into tomorrow is by looking at its purchasing power yesterday and the day before that. Things that are stable tend to stay stable; so, if a currency has maintained purchasing power adequately well for individuals' lifetimes, then they will base their forward projections upon that firm foundation. And, like an object moving in space, these projections are propelled along a steady trajectory by inertia – in this case, the cumulative experience of a generation. They won't divert from the path they're without meeting a sizable external force.

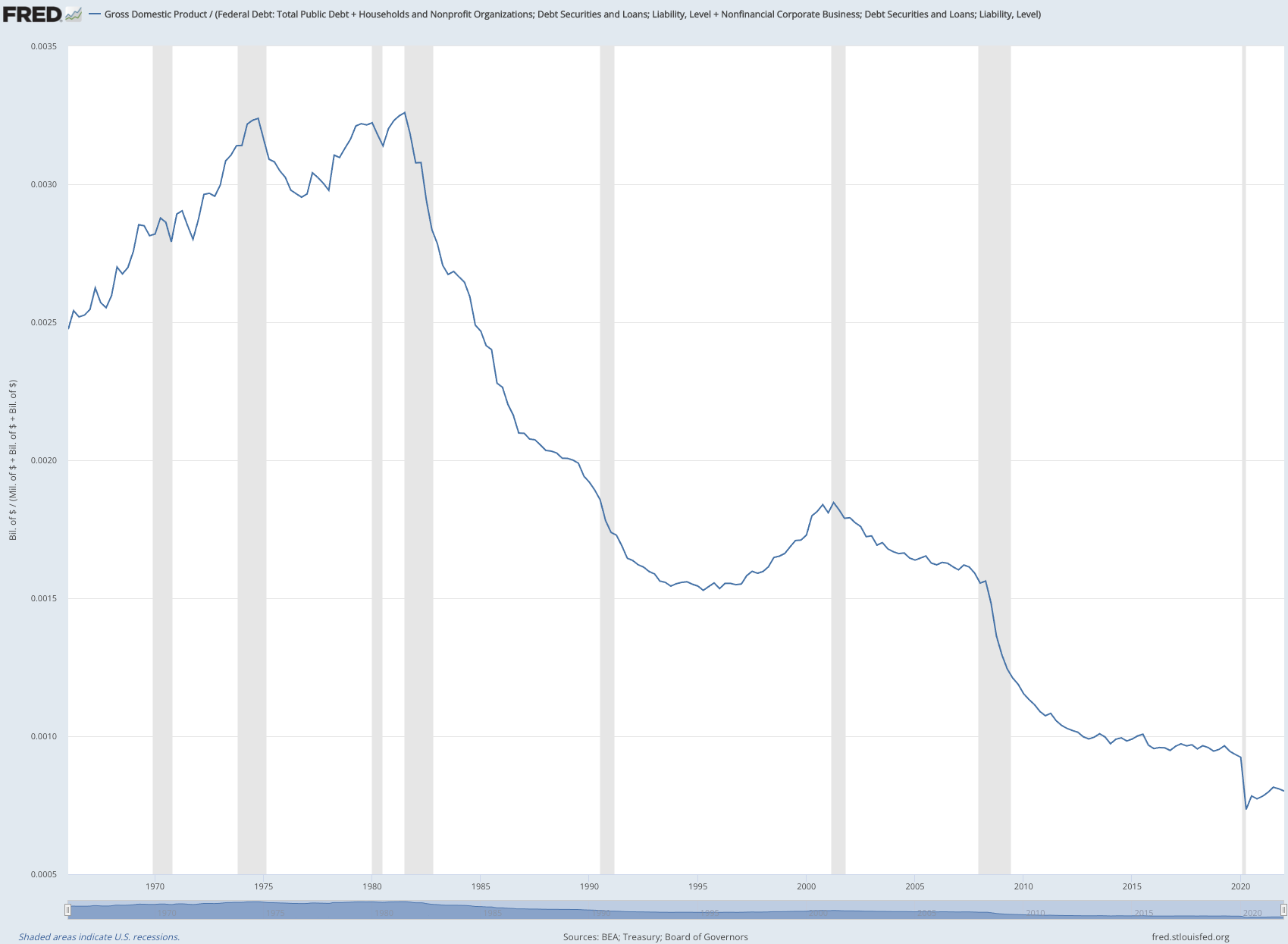

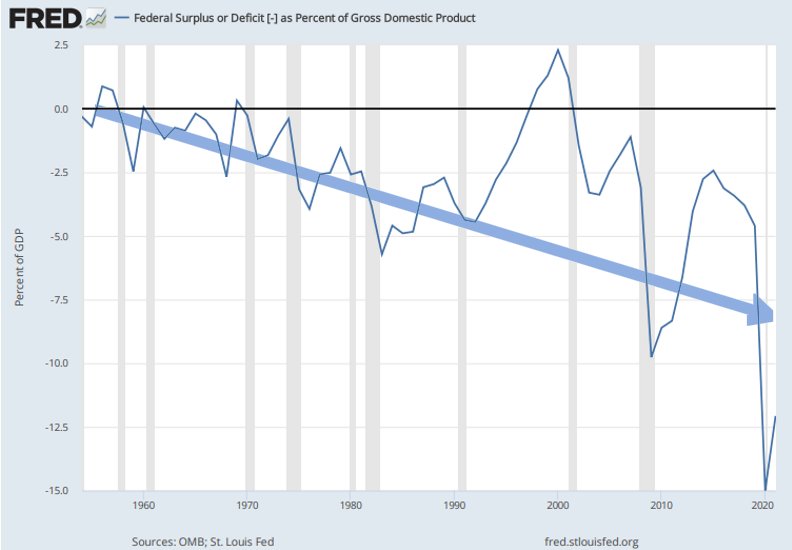

That force would be the near universal realization that the government's fiscal pathway is deeply unsustainable. Its unsustainability lies not so much in the fact that the current level of debt is extreme (it's the highest in history), but that the productivity of the debt we've incurred has declined for four decades consecutively. As seen in Graph 1, since 1980, every additional dollar of debt we've taken on has paid for less and less economic growth. In other words, financing growth has gotten more and more expensive. We keep squeezing the same lemon and get less juice out of it every time.

The inefficiency of that capital allocation is astounding. Since 1966, our total debt level has risen 68x while our total interest payments have increased only 31x. I.e. we've borrowed a ton of purchasing power without having to pay a commensurate amount for that privilege. More specifically, our debt grew at a compounded annual rate of 7.9% for 54 years while our interest costs grew at 6.5%. In other words, people paid us 1.4% every year for 54 years to borrow every additional dollar. One would expect half a century of free arbitrage measured in the trillions to cause growth to explode. Yet, the economy grew at 6.2%. Our income didn't even keep pace with our interest costs, no less our debt. The only way we've been able to make our interest payments is by incurring more debt to service our old debt. That is unsustainable.

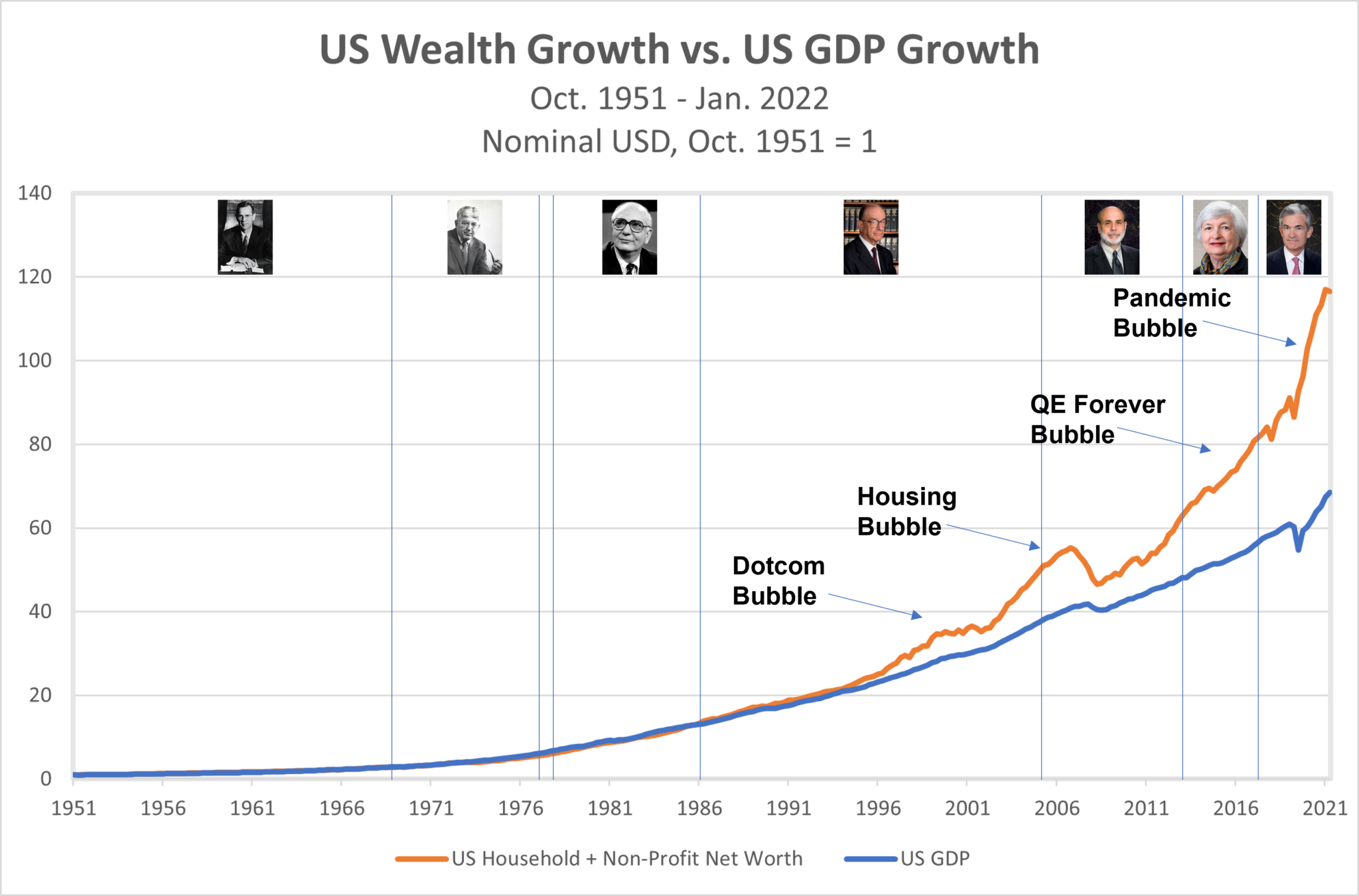

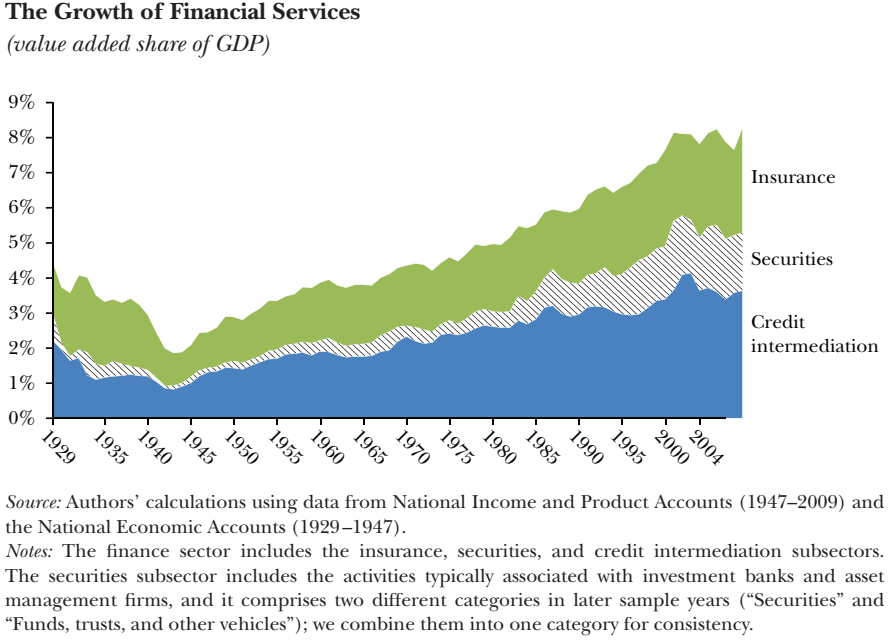

A high-level explanation for this unprofitable expansion is that we prioritized the financialization of the economy over the economy itself. Beginning in 1971, we became the reserve currency of the world (which necessitates exchanging pieces of paper for goods) and took on debt to buy financial assets (leveraging up the stock market, not investing in the real economy) while shipping our manufacturing capabilities to China (actively divesting from the real economy). Our paper wealth went up, but our real wealth – the ability to produce goods & services of value to others – lagged well behind. It's like a CEO so entranced by the price of their stock going up that they spend their good money to conduct financial engineering and borrow money they didn't earn to pump up the ticker price more while forgetting they have a business to run and customers to tend to. Our paper wealth is represented by the orange line in the Graph 2, while our real wealth by the blue line. This differential can be sustained only as long as the world continues accepting our pieces of paper in exchange for their real wealth. It may make me a skeptic but I'm unconvinced that we can continue stealing purchasing power from future generations of Americans and from foreigners forever.

All of this is to say we've been living well beyond our means for some time. Continuing to inflate our standard of living (a phenomena that feels like a natural born right at this point) will require taking on more and more debt. And, it certainly feels like that's the plan. The federal gov has broadened its spending for decades now as seen in Graph 3. More specifically, it's borrowed not just greater and greater amounts, but greater and greater amounts relative to the economy. And, now we face a distinctly daunting range of issues from climate change to wars to globalization reversing to combatting historic income inequality, all of which will necessitate the further dialing up of the printing presses.

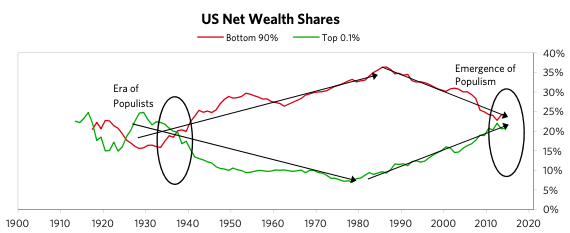

Reaching our climate change goals by 2040 will require by some estimates $1.9T in spending a year on renewable development vs. the current pace of $800B. The apparent reversal of globalization, spurned by the post-COVID realization that we've over-optimized the efficiency of our supply chains at the expense of their resiliency, will require massive capex (e.g. a single semiconductor plant is estimated to cost tens of billions to build, not including costs to operate it). The re-shoring of our manufacturing was also encouraged by concerns over national security and the hollowing out of the middle class. The former relates to the fact that we're currently fighting a proxy war with our Cold War era nemesis in Russia and tiptoeing around a potential standoff with China. The latter relates to the fact that all this financialization has alas only helped those who own financial assets: the rich. This led to income inequality only seen in the 1920s. Turns out there's still no free lunch.

Not only do we have some economic realities staring us in the face, we have the political champions to match. As Ray Dalio & Co articulates, it's not a coincidence that the last time the world saw the rise of socialism, populism, and communism was in the 1920s. Today we have AOC and Trump singing the same songs, just with slightly different tunes. Indeed, the liberals have gravitated towards socialism while the 'conservatives' have drifted towards populism. They're now at adjacent positions on the political donut.

Thus, it appears that whichever party is in office will be intent on letting open the floodgates for the foreseeable future. The last three years have provided evidence of the bipartisan support for spending more money we don't have. We've seen the following policies from both a Republican and a Democrat president: historic tax cuts, thousands of dollars sent to the mailbox of everyone with a pulse (and to many without one), and bipartisan discussion of spending measured in the trillions to rebuild our infrastructure & expand our renewable capacity. Not coincidentally, the proposed bill is called the Green New Deal.

All of this is to say that we've had a half century of inefficient spending and a publicly broadcasted intention to ramp that spending up to ever greater scales. The key, as always, is how productive this coming spending will be. Some of it sounds, at least at the surface, to be wonderfully productive: re-shoring our manufacturing, rebuilding our infrastructure & investing in a renewable grid are policies that the master capital allocators like Bezos or Buffett would surely approve of were they to run America, Inc. Others, like financing wars and figuring out what to do about the ~$100T we owe in entitlement payments, will be deeply negative returning projects.

More specifically, the keys will be to continue watching the compounded growth in our aggregate interest payments vs our income (the best measure of our debt's sustainability) and the willingness of the citizens & foreigners to continue storing their wealth in our debt & currency. Both depend greatly on the productivity of our spending, as discussed above.

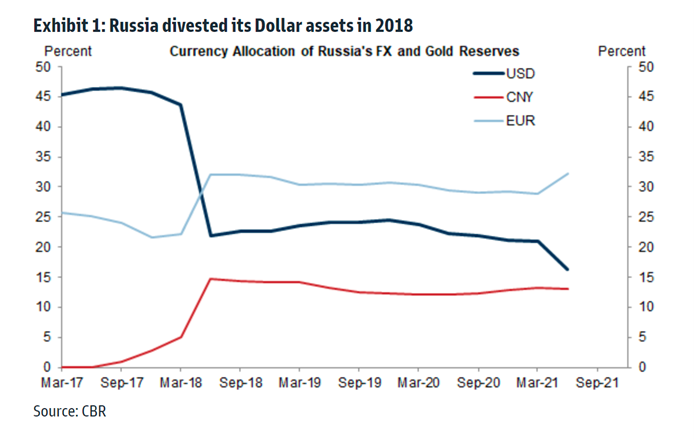

Foreign willingness to hold our currency & debt appears that it may already be subject to the shifting of tectonic plates. The West's weaponization of the global financial system against Russia following its invasion of Ukraine has made other major users of USDs and USTs with questionable moral standards second guess being at the whims of the US's political agenda. I imagine that Xi Jinping might sleep better if his $3-4T of accumulated savings stored in US assets wasn't subject to confiscation at any moment – it doesn't exactly jell with his daydreams of invading Taiwan (not to mention disagreements over Hong Kong, the Muslim camps, tariffs, etc.).

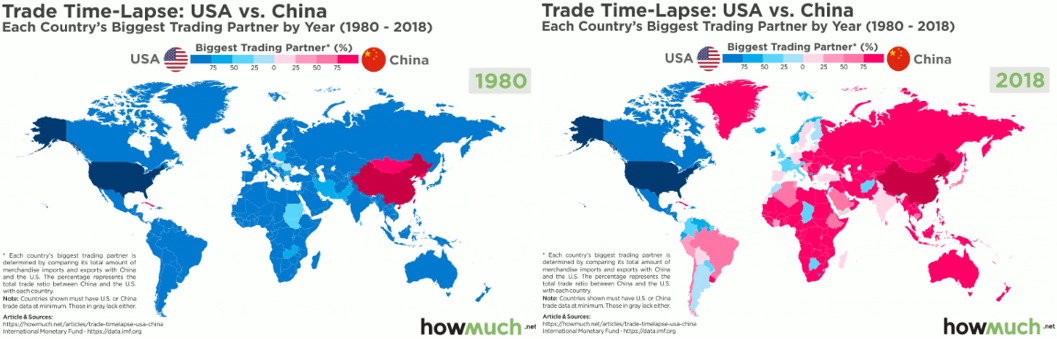

While these countries cannot dump their USD & UST holdings tomorrow, it seems most plausible that they'll allow their exposures to naturally mature while recycling that money into other, non-seizable stores of wealth: mainly commodities and non-western currencies. Indeed, this has already been occurring on large scales for years, despite limited news & scholarly coverage. Russia began replacing its dollar reserves with other currencies three years before its invasion while China's Treasury holdings have slipped ~25% since their peak in 2010. Moreover, the share of USD settlement in their bilateral trade fell from 90% in 2015 to 46% in 2020, the two partners launched their own cross-border payment mechanisms as an alternative to SWIFT, and most recently the BRICS nations announced they are creating their own basket reserve currency to compete head-on with the current US-based system. While these articles (1,2,3) note the practical difficulties of such efforts to cut off exposure to dollars entirely in exchange for the new BRICS currency, the actions already taken by these nations combined with Putin's palpable passion (try saying that three times fast) for de-dollarization as evidenced by this speech he delivered a month ago make the direction of policy and the intention to overcome logistical obstacles clear. This should not be overlooked given that the BRICS nations account for 24% of global GDP and 16% of world trade, while China has become the primary trade partner for nearly the whole globe.

Now, I know this was a long detour from the initial discussion of framing cryptonetworks as sovereign digital economies. Why was this necessary detail and how does all of this relate to the original topic? We last left off in cryptoland talking about the potential for such a sovereign digital economy to creep into the turf of a physical sovereign. So, let's sketch out the last 40 years' mega-trends we dove into to flesh out why that might actually occur:

- We've traded pieces of paper for real goods, sacrificing the real economy while inflating asset prices in the process

- We've taken on more and more unproductive debt

- We now have a variety of issues to tend to that will require taking on even more debt: re-shoring our manufacturing & supply chains, rebuilding our infrastructure, fighting wars as well as climate change, and dealing with historic income inequality, an aging population & $100T in pension unfunded liabilities (much of which is owed to the boomers about to retire)

Now, let's compare that to the linchpin holding up our financial system: the willingness of individuals to transact in and store their wealth in our currency & debt. Once again, that depends on a) people's expectations for the currency's purchasing power in the future and b) access to attractive alternatives.

a) cannot be observed directly since it's the aggregation of people's internal, subjective perceptions of the future. While time will tell what will happen with Americans' willingness to hold our own debt (that depends largely on their understanding of the topics discussed above as well as the productivity of our future debt-financed spending), it seems to me that foreigners' willingness to hold it is moving definitively downwards.

b) is more concrete. In the last decade, non-Western nations have created their own alternative and seem intent on using it. Meanwhile, cryptonetworks are a budding alternative for Westerns to tinker with. Westerners transacting in and storing more of their wealth in these assets may arise for one or both of the following reasons: their usefulness in solving their everyday issues (i.e. if people begin to work in and for cryptonetworks like they do the internet) and their usefulness as a store of value to avoid participating in America's paper wealth veering towards its real wealth (likely such a use case would be solved by a mix of hard commodities like gold and crypto depending on the speculator's age). These trends are still highly speculative and in infantile stages; it will take another decade or so for those questions to be resolved. In the meantime, one can observe politicians' rhetoric towards crypto as a barometer of the political pressures they feel. If usage of a cryptonetwork does scale to truly warrant the title "sovereign digital economy," politicians will sense an internal conflict in their journey to getting re-elected. On the one hand, their constituents' patriotism towards the cryptonetwork they participate in would incentivize a nurturing attitude. On the other, the restrictions that a legitimate monetary alternative places on politicians' ability to go on shopping sprees & the existential threat they would represent to the US hegemony over the global financial system would yield a scene more similar to someone standing between a mama bear and her cub.

The last time the US long-term debt cycle (i.e. unmanageably high debt w/ interest rates already at 0%) busted in 1929, people fled to store their wealth in a sound money – gold. As noted by Ray Dalio & Co in his book the Changing World Order, this process tends to repeat itself:

So, what happened next? In one fell stroke of the pen, the government simply signed a bill making the holding of gold illegal and punishable by up to 10 years in jail and/or a fine equivalent to $200k in today's dollars. Whether they do that with crypto would depend on the anticipated response of the public: do they view it as high ground to run to and would banning the right to run to that hill ignite widespread outrage? After all, politicians do whatever presents them with the best chance of reelection. For them, like anyone else, it's a cost-benefit analysis.

[Note: if you find yourself in a conversation with a cryptohead on the subject, they might become triggered and launch into a crusade on how crypto's decentralization means the gov cannot take your crypto. At that juncture, I'd recommend reminding yourself that gold was decentralized too, but it wouldn't have done you much good to stuff it under your floorboards and wait for 40 years until the law was reversed so you could realize its partially restored economic value. Far more importantly, remind yourself that the gov can always take you. Personally, I'd rather trade in my crypto at market price than risk spending 10 years in jail if it comes down to that. I'd also prefer trying to smell that sh*t coming, vote with my feet beforehand and take my crypto with me if I believe it's heading that way. Either way, once you've reminded yourself, it's personal preference over whether you'd like to remind your partner in conversation of these subtleties.]

And once again, it's highly uncertain that crypto will ever become such a force. Today, it's little more than an online casino. The point of this piece was not to argue that it will happen, but to explicate both the trends that have made such a pathway open up and the full implications of what it would mean to walk all the way down that path. Crypto bros like to toss around analogies comparing their darling network to this or that nation state, but one should not be so nonchalant. The full implications of such a statement are nothing short of the meltdown of the global financial system as we know it and the third modern iteration of such a system (what people are already titling "Bretton Woods III"). While I think that would actually be tremendously positive for humanity in the long run because unalterable monetary constraint is the only reliable restraint on the excesses and poor decision-making of politicians, it'd demolish the livelihoods of hundreds of millions if not billions of people in the short-term.

Considering the macroeconomic trends outlined above combined with the rapid development of the technology, the probability of it occurring are still significantly underrated by most. It lies somewhere between negligible and probable, though closer to the former. Let's call it ~10% odds. If it were to happen, it'd still be a minimum of 10-15 years out. Of course, time will tell.

The best resources to understanding these trends more deeply are the following:

Macroeconomic & big picture:

- Ray Dalio's Changing World Order, Big Debt Crises, and twin pieces on Populism (1, 2)

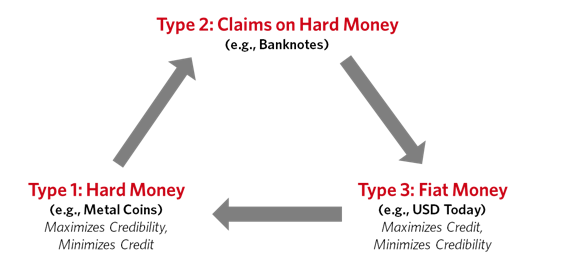

- My piece on what makes a good money

- Arthur Hayes' piece on the implications of weaponizing of our financial system

How crypto fits into this trend:

- https://open.spotify.com/episode/5gXMjXVatEVuajtsgCR6ah

- https://open.spotify.com/episode/7tigpgcGreaPgpvTG88MAm

- https://taschalabs.com/blockchain-nations-the-surest-bet-in-crypto/

- https://taschalabs.com/7-industrial-policy-tactics-blockchains-can-learn-from-nation-states/

- https://newsletter.banklesshq.com/p/the-first-profitable-blockchain?s=r

- https://newsletter.banklesshq.com/p/ether-a-new-model-for-money?s=w

- https://open.spotify.com/episode/4uDTV0m5w5D7rKyO3kNIDC

- https://timevalueofbtc.medium.com/the-bitcoin-second-layer-d503949d0a06