The Pressure Continues

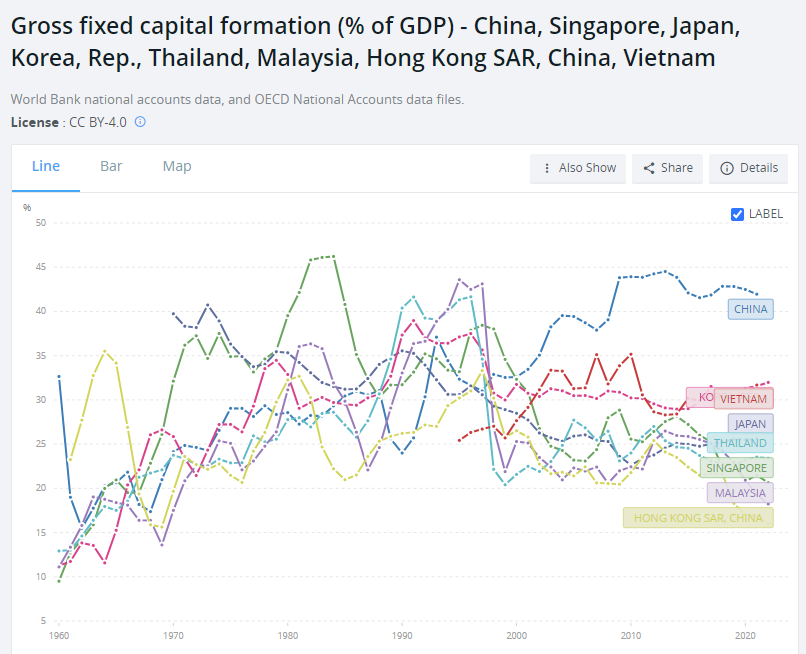

The debt-fueled, deflationary real estate bust ~with Chinese characteristics~ picked up steam once again. As I covered in my last long-form post, China has followed an even more extreme version of the investment-driven growth model employed by many Asian countries in their respective development phases:

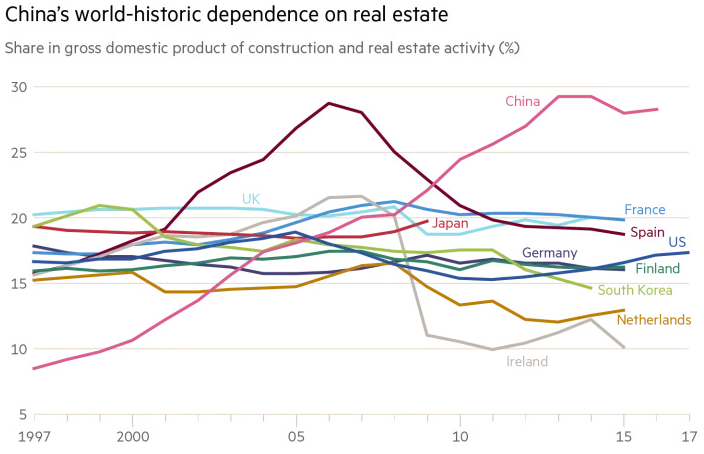

Much of that investment being in housing:

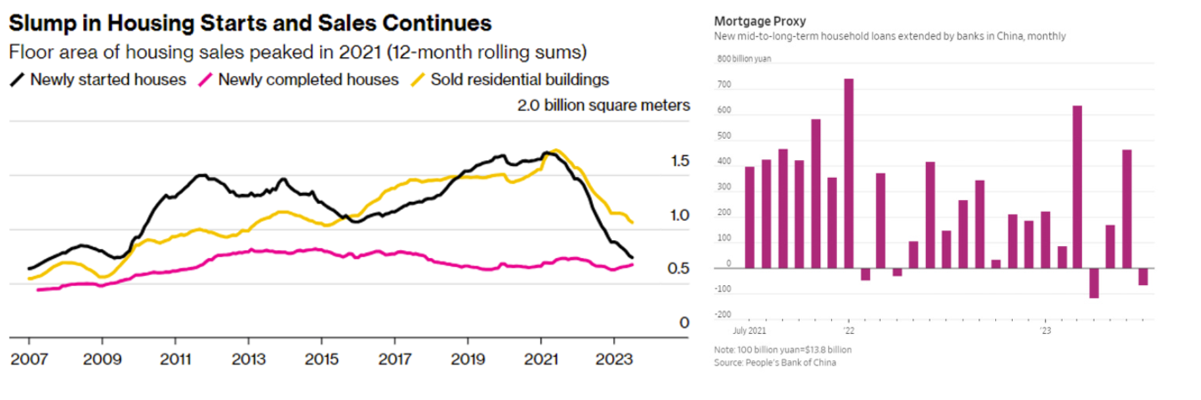

As I discussed in detail, that investment got increasingly speculative and economically unproductive over time. Now the chickens have come home to roost. In fact, they keep coming. A year and a half ago, the world's largest property developer, Evergrande, defaulted. The pressure temporarily eased as housing prices saw respite thanks to the short-lived economic rebound as China emerging from its zero-COVID policy and the market being propped up by the gov. As seen in the charts below, the pressure resumed in July. The top right is the most concerning chart when it comes to longer term prospects assuming the survey data is representative of the broader population. The continuation of a speculative bubble relies on the wide spread belief that prices will go up, forever. If that dream has been spoiled, the real estate sector's massive contribution to GDP growth might never be the same moving forward.

This renewed downward trend put particular heat on the largest remaining private developer, now on the doorstep of Chapter 11:

The financial struggles of Country Garden Holdings 2007 1.25% increase; green up pointing triangle, China’s top surviving privately run developer, have been front-and-center since it missed interest payments on two U.S. dollar bonds a week ago. The property giant said over the weekend that trading in 11 of its yuan-denominated domestic bonds has been suspended, and that it intends to discuss repayment plans with investors. Country Garden’s Hong Kong-listed shares, which had been relegated to penny-stock status last week, fell another 18% on Monday. Country Garden admitted to having liquidity problems last week and said it expects to post a big first-half loss. Before the downturn, Country Garden’s annual contracted sales were close to that of Evergrande’s by total value, but the former’s larger presence in China’s less prosperous cities meant it sold more homes at cheaper prices. Country Garden also has a lot of unfinished property projects, as it was common for Chinese developers to sell partially built homes along with commitments to complete them in a few years. The company’s contract liabilities, a proxy for its unfinished projects, totaled the equivalent of $92.3 billion at the end of 2022, according to Country Garden’s last financial report. (WSJ)

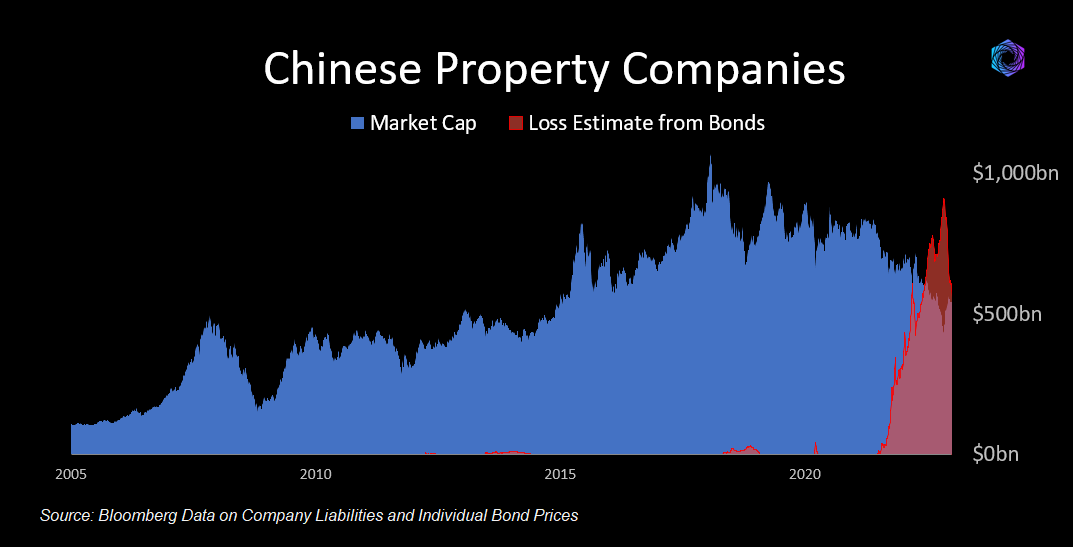

But it turns out Country Garden isn't so special:

Eighteen out of 38 state-owned enterprise builders listed in Hong Kong and the mainland reported preliminary losses in the six months ended June 30, up from 11 that warned of full-year losses in 2022, according to a Bloomberg tally based on corporate filings. Two years ago, only four firms with controlling or major state shareholdings posted losses. (Bloomberg)

Indeed, as of April, the entire market was estimated to be swimming under water:

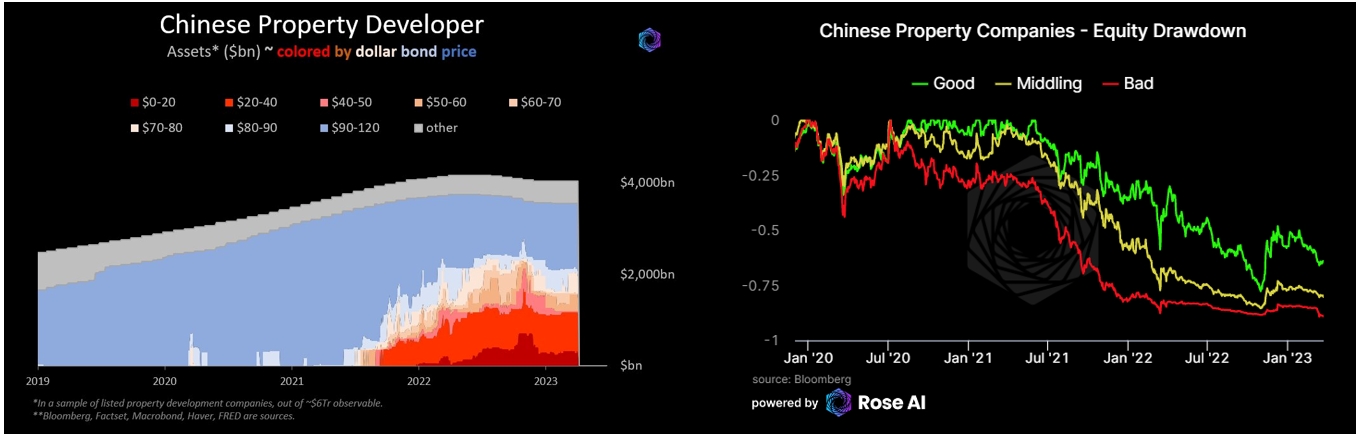

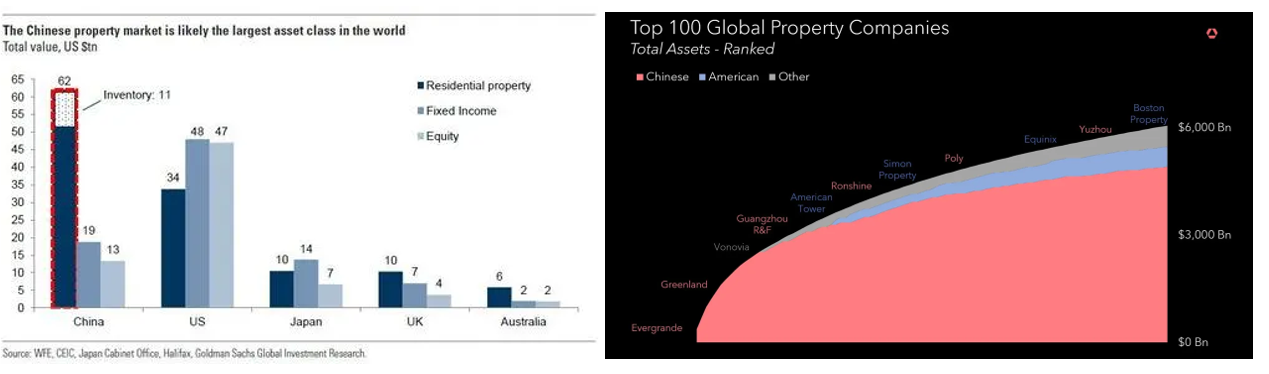

Insolvency never looks pretty, but it's especially ugly on the largest asset class in the world:

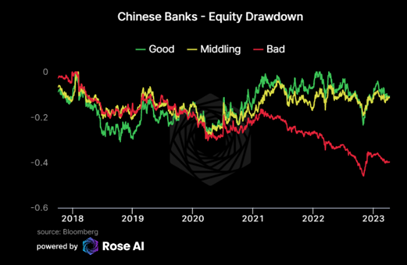

Of course, the firms whose duty it is to lend to these developers aren't doing too hot either:

Unfortunately, these things typically take time, especially when the bubble's so inflated scale:

So, what happens next? Well, you can't have 1/4 of your GDP fall off a cliff, so monetary policy will be easy for a while. This week, the PBoC cut policy rates by 15bps to 2.5%. [Interesting to note they didn't cut mortgage rates.] Expect more monetary stimulus.

The only trouble with monetary easing is it puts more pressure on the yuan, already at the low end of its implicit bounds. China has tasked their state controlled banks to intervene in the currency markets, as opposed to the central bank itself. Whether China allows it the break that threshold or not is a purely political decision. It has more than enough reserves to defend it if it so chooses. They did so to the tune of ~$500B in 2015 when the downward forces were comparable. And, today the state banks have ~$1T in foreign net assets, a significant chunk of which is sufficiently liquid to use for this purpose (say, $300B). Meanwhile, the PBoC has over $3.2T in reserves left as well. So, while currency traders will likely keep China from completely opening the monetary flood gates, China can handle whatever they bring at them if it so chooses to act.

The more interesting question is fiscal stimulus. As has been argued at length by people like Michael Pettis, China needs to transfer money to households. However, that's proven politically unpalatable as it necessitates fundamentally restructuring the economy to a consumption-led model, taking money & power away from the people whom have gotten both from the current model (local government officials and owners of large manufacturers), and giving that money & power to the people. As such authorities seem reticent to do direct stimi checks like the US. Officials fear it would breed softness and complacency. Apparently, it comes all the way from the top: "Xi Jinping has deep-rooted philosophical objections to Western-style consumption-driven growth, people familiar with decision-making in Beijing say. Xi sees such growth as wasteful and at odds with his goal of making China a world-leading industrial and technological powerhouse."

In addition to Xi's fondness for all work and no play, other officials believe in the potentially valid logic that direct stimi checks would be an ineffective way to meaningfully boost demand because consumers will largely stash it away given their 33% savings rate. But there's plenty of more efficient ways of boosting spending and supporting the housing market, like making the regressive tax system less regressive or providing a better social safety net (a main reason for the citizen's high savings rate). Time will tell if this happens or if Xi once again opps for subsidies to manufacturers.

In the mean time, China's other growth engine is also hurting. Exports, which represent 14% of the economy, continue to sag as Americans now want vacations not goods.

All this will take time to play out, especially in China where everything from GDP growth rates to whether a particular property developer announces bankruptcy when to household financial health is guided by the political process that is the 80-million-person CCP machine. It's not a country where sudden-stop financial crises like the GFC are likely to occur. No, WSJ, China won't have a Lehman moment. The aftermath of an asset bubble burst and economic restructuring are far more likely to be depreciated over decades.

Whatever happens in China, the deflationary pressures will make Jerome Powell's job easier on the margin.